Companies headed for listing are being examined with a wider lens on who all should be named as ‘promoters‘.

Stock exchanges, which do the first level of scrutiny of companies planning initial public offerings (IPOs), are taking a broader view on the definition of promoters.

In identifying a company’s promoters, the bourses are focusing on shareholders owning 25% or more equity who they believe exercise a degree of ‘control’. Also, they are including in the list of promoters those persons who have a significant ‘influence’, sources told ET.

For instance, an individual with very little shareholding in the company may still hold sway over several directors by virtue of his familial connections and board presence. Or, a founder, who is neither a ‘key management personnel’ (KMP) nor a member of the board, but owns 20% equity stake, would be categorised as promoter even if he chooses not to use the tag.

According to Kaushik Mukherjee, partner at IndusLaw, “A promoter, by definition, is a fact-based subjective test and not an objective test. The current trend of attributing control based on a shareholding percentage though not part of the law directly seems to be the position the regulator is taking these days. It is a reaction to mischief where persons in control have not been classified as promoters in certain cases and so the rationale for this position is quite clear. One has to be careful though as persons who are not in control may also fall within the net.”

GREATER OBJECTIVITY

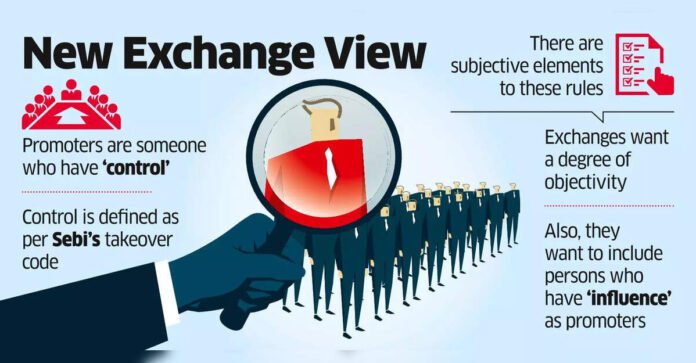

Under the Issue of Capital and Disclosure (ICDR) norms of the Securities & Exchange Board of India (Sebi), promoters are defined as persons who have control over the affairs of the company, directly or indirectly, as a shareholder. And ‘control’, defined as per the Sebi takeover code, includes the right (i) to appoint majority of the directors or (ii) to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders’ agreements or voting agreements or in any other manner.

Exchanges are now going into granular details and fixing a minimum shareholding in lending objectivity to the subjective features in the regulations. On one hand, exchanges are considering a minimum shareholding of 25%. On the other hand, they are also going beyond the traditional percentage-based and quantifiable elements like large shareholding, rights stemming from shareholder agreements, and veto powers that typically give control. Here, they are also evaluating the nature and degree of influence a person has.

According to Sudhir Bassi, partner at the law firm Khaitan & Co, “There are persons in a company who may not own majority shares and may lack control in the usual sense of the term. But nonetheless, they may wield a significant influence-in whose directions the board of directors are accustomed to act. Exchanges, probably to instil better corporate governance and accountability, want to identify such persons in a company before they go for listing and raise money from the public.”

The stance taken by the exchanges have not gone down well among some. Such persons do not want to be named as promoters as they do not want to expose themselves to any civil or criminal liabilities later.

Stock exchanges did not comment on the subject. A person in the investment banking industry said that exchanges have verbally expressed their views in some of the interactions, and IPO-bound companies are being advised by their merchant bankers to be ready for a more comprehensive definition of promoters. Sources said that there have been some discussions between the regulator and exchanges on the matter.

THE DIFFERENT TESTS

Sources said that in recent IPOs, exchanges have said that the following persons shall also be considered as promoters of an issuer:

l A person who is an immediate relative of the promoter and (i) is holding a position, or has the right to be nominated in the board /KMP; or, (ii) holds more than 10% of the shareholding of the Company (directly or through persons/entities controlled by such person;

l A legal entity controlled (directly or indirectly) by the promoter or the promoter Group, and holds 20% or more equity;

l Any person/ legal entity(ies) holding 25% or more of the company’s share capital directly or indirectly;

l A person designated as a founder and has at least 20% stake;

l If the promoter is an unlisted company, then ultimate individual controlling this entity shall be classified as a promoter.

All this was triggered by a case where the founder of a new-age company, choosing not to be classified as a promoter, received stock options which are meant for employees. However, the overarching reason behind the new approach of exchanges goes beyond promoters giving themselves employees stock options (ESOPs): it is aimed at fixing accountability on all persons who can control or influence, or do both.

[ad_1]

Source link