[ad_1]

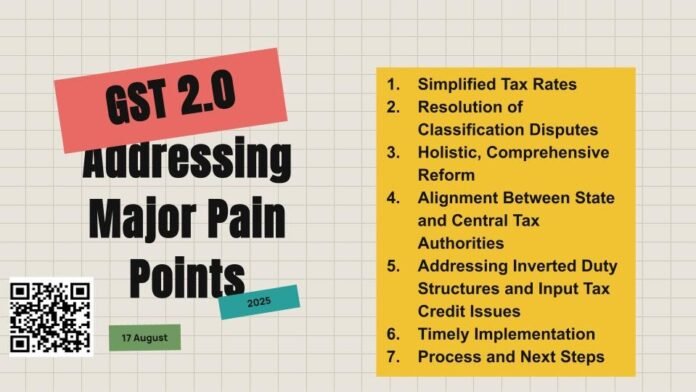

The upcoming GST 2.0 revamp proposes comprehensive solutions to several long-standing challenges faced by businesses and consumers in India. Here are the key features and reforms of GST 2.0:

1. Simplified Tax Rates

- The 12% and 28% GST slabs are proposed to be scrapped, retaining only the 5% and 18% rates.

- Most daily consumption items, agriculture-related goods, and health-related products are expected to be taxed at 5%.

- A new special rate of 40% will be introduced for about half a dozen “sin goods” (e.g., tobacco, luxury cars), which are considered harmful or high-end luxury items.

2. Resolution of Classification Disputes

- GST 2.0 aims to resolve conflicts in classifying goods that led to different tax rates based on subtle differences (e.g., whether a snack is sweet or savory, extrusion-based or non-extrusion-based).

- No differentiation will be made based on product prices for the same good.

- These changes will prevent ambiguity and divergent court decisions on taxation.

3. Holistic, Comprehensive Reform

- Prior GST changes were often piecemeal; GST 2.0 introduces a complete overhaul of structure and classification.

- The goal is to reduce frequent amendments and make GST more predictable and business-friendly.

4. Alignment Between State and Central Tax Authorities

- Greater coordination in assessment, audit, and investigation will prevent businesses from facing multiple actions for the same issue.

- Enhances cooperation between different levels of government for smoother compliance.

5. Addressing Inverted Duty Structures and Input Tax Credit Issues

- GST 2.0 will tackle problems related to wrongly structured duties and input tax credit utilization.

- This should help businesses by making input credits easier to claim and more transparent.

6. Timely Implementation

- The GST Council, India’s apex policy body for GST, is set to meet on September 18-19, 2025 to deliberate these changes.

- The government aims for implementation in time for the festive season, targeting increased domestic consumption and growth.

7. Process and Next Steps

- The proposal was sent to the group of ministers (GoM) for rate rationalisation.

- After GoM’s review, recommendations will be put before the GST Council for approval.

- Detailed discussions with state governments will follow, focusing on smooth rollout and alignment.

In summary: GST 2.0 aims to simplify the tax regime, resolve long-standing disputes in goods classification, and ensure more effective coordination between central and state authorities. By streamlining rates, addressing technical issues, and focusing on holistic reform, the government hopes to boost consumption and fuel economic growth.

[ad_2]

Source link