[ad_1]

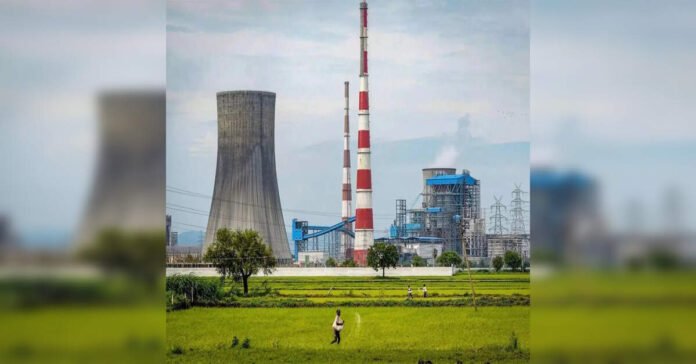

Trilegal has advised American alternative investment management firm Värde Partners on completing its exit from investment exposure to RattanIndia Power through the sale of security receipts to RattanIndia Finance. Khaitan & Co advised RattanIndia on the deal.

Värde Partners was a part of the consortium of investors in 2019, which had implemented restructuring and one-time settlement of the entire outstanding debt exposure of RattanIndia Power through Aditya Birla ARC.

The original transaction for the debt resolution of RattanIndia was the largest one-time-settlement (“OTS”) transaction in India and the first OTS transaction of its kind involving international credit funds such as Goldman Sachs and Värde Partners.

It was also the first successful scheme to have been closed under the RBI’s Prudential Framework for Resolution of Stressed Assets issued in June 2019.

The Trilegal team was led by partners Yogesh Singh, Ankush Goyal and Aniruddha Sen, and supported by senior associate Rohan Kohli, and associate Shubh Arora.

Khaitan’s team was led by partners Kumar Saurabh Singh and Abhimanyu Bhattacharya.

[ad_2]

Source link