[ad_1]

Introduction

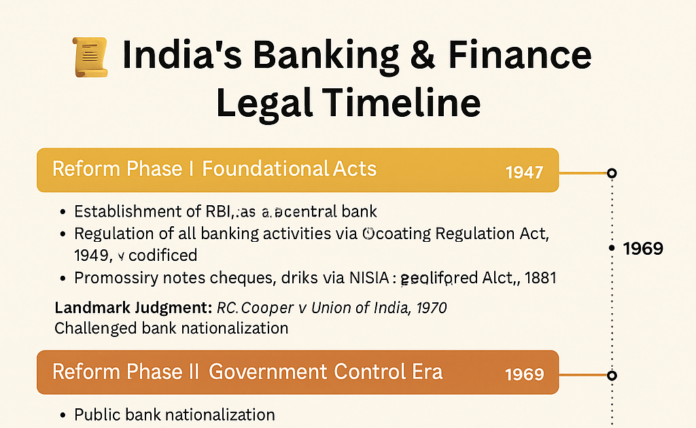

India’s banking and financial regulatory landscape has undergone massive transformation since independence in 1947. The development of a robust, transparent, and accountable financial ecosystem has been critical to India’s economic journey. This article presents a detailed timeline of major banking and finance laws, highlighting the evolution, key provisions, landmark judgments, and outcomes that have shaped the current regulatory framework.

1. Post-Independence Era (1947 – 1968)

Key Developments:

-

Inherited colonial-era legislation like the Indian Companies Act, 1913 and the RBI Act, 1934.

-

Initial focus on strengthening control over banks and preventing failures.

Major Acts Introduced/Revised:

-

The Reserve Bank of India Act, 1934

-

Continued as the foundational law for central banking in independent India.

-

Empowered RBI to regulate currency, credit system, and monetary policy.

-

-

The Banking Regulation Act, 1949

-

Extended RBI’s control over the banking sector.

-

Allowed for licensing, inspections, and liquidation.

-

Landmark Judgments:

Outcome:

2. Nationalisation and State Dominance (1969 – 1990)

Key Developments:

Major Events:

Outcomes:

Judgments:

3. Liberalisation and Reforms Era (1991 – 2005)

Key Drivers:

Major Reforms:

-

Narasimham Committee I & II Reports

-

Led to phased reforms in banking.

-

Suggested reduction in SLR/CRR, recapitalization, and asset classification norms.

-

-

Introduction of Private Sector Banks (1993 onwards)

-

Setting up of SEBI (1992)

Key Acts:

Judgments:

Outcome:

4. Modernisation and Risk Management (2005 – 2014)

Focus Areas:

Major Initiatives:

-

Basel II & Basel III Implementation

-

Introduction of Credit Information Companies (CIC) Regulation Act, 2005

Judgments:

Outcome:

5. Regulatory Overhaul and Digital Finance (2015 – 2020)

Key Drivers:

-

Fintech boom, JAM trinity (Jan Dhan, Aadhaar, Mobile), and financial frauds.

Major Developments:

-

Insolvency and Bankruptcy Code (IBC), 2016

-

Payment and Settlement Systems Act, 2007 (amended)

-

Digital Lending Guidelines (2020 onwards)

Landmark Case:

Outcomes:

-

Structured insolvency framework.

-

Rise of fintech, UPI ecosystem.

-

Focus on consumer protection.

6. Resilience, Compliance, and Technology Integration (2020 – 2025)

Themes:

Key Initiatives:

-

Scale-Based Regulation (SBR) for NBFCs, 2021

-

Digital Personal Data Protection Act, 2023

-

Updated Master Directions:

-

KYC, Cybersecurity, Digital Lending, IT Governance

-

Judgments:

Outcomes:

-

Greater accountability and audit focus.

-

Rise of regulatory sandboxes and innovation hubs.

-

Cybersecurity and outsourcing under sharper focus.

Conclusion: The Road Ahead

From a tightly controlled state banking structure post-independence to a globally integrated financial sector, India’s banking laws have evolved rapidly. The shift from physical to digital, the emergence of fintech, and increasing focus on consumer data and resilience are hallmarks of the post-2020 era. As the RBI and other regulators continue to refine the frameworks, focus areas remain:

-

Data privacy and cybersecurity

-

ESG and sustainable finance

-

Cross-border compliance and digital currencies (CBDC)

With continuous reforms and landmark rulings balancing rights and responsibilities, India’s financial sector is now more inclusive, innovative, and institutionally sound than ever before.

Appendix: Key Acts in Chronological Order

-

RBI Act, 1934

-

Banking Regulation Act, 1949

-

SEBI Act, 1992

-

SARFAESI Act, 2002

-

Credit Information Act, 2005

-

IBC, 2016

-

Payment & Settlement Systems Act, 2007

-

Digital Personal Data Protection Act, 2023

[ad_2]

Source link